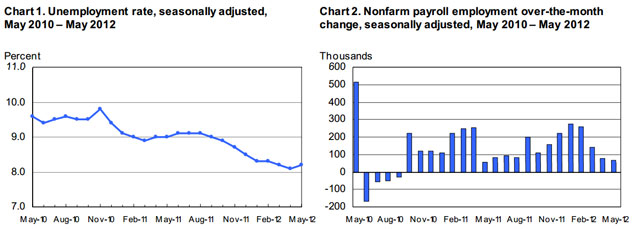

Total employment in the U.S. grew by 69,000 positions in May and unemployment grew for the first time in more than a year from 8.1 to 8.2 percent as nearly half a million high school and college graduates entered the workforce. Revisions to April’s employment numbers showed that just 77,000 jobs were added that month, rather than the 115,000 first reported.

Healthcare, which has continued to be a stalwart of growth, was the top-growing industry segment in May, adding 33,000 positions. Close behind was transportation, where 20,000 passenger ground transportation jobs were added. Wholesale trade and manufacturing also both tended upward during the month, adding 16,000 and 12,000 jobs, respectively.

On the whole, professional and business services were essentially flat, but within that grouping, accounting and bookkeeping services trimmed 14,000 positions in the post-tax season. The losses were counteracted by gains in temporary help services, 9,200, and computer systems design and related services, 5,300. The unemployment rate of people in management, professional, or related occupations was down to 4.0 from 4.4 a year ago.

Some of the largest losses outside of accounting were services to buildings and dwellings, 14,300, specialty trade contractors, 17,700, and amusement, gambling, and recreation, 16,600. Although these losses were drawing down the total number of jobs gained in May, it is worthwhile to note that they are seasonally adjusted numbers in largely seasonal industries. In fact, in unadjusted numbers, services to buildings and dwellings grew by 61,200, specialty trade contractor by 96,500, and amusements, gambling, and recreation by 75,800.

In total unadjusted numbers, 789,000 jobs were added in May, largely being filled by students graduating high school and college. Seasonally adjusted numbers are important in understanding the month-to-month trends in total employment. Yet, they can give the impression that doormen, carpenters, and blackjack dealers are being laid off en masse. While some invariably are laid off in any given month, in May their hiring was just not as robust as a typically May, which is understandable in the current climate.

Europe’s economy is–at best–at a standstill, China is decelerating, and the U.S. presidential election entered its general phase with key issues regarding business regulation, and fiscal and monetary policy being sharply debated. Despite these uncertainties, employers are hiring for the crucial roles that need to be filled. May’s report was not a glowing opus on the state of the employment market, but it was far from a disaster. It will be several months until a more definitively negative–or positive–trend can emerge from an economic climate that continues to be draped in a degree of uncertainty.